College life is probably the best time to make memories, to have experiences, and to develop yourself. But, once you get out of the college, your life will take a different turn. After graduation, one has to make a lot of crucial decisions and plan accordingly for the future. You will be exploring a lot of places, opportunities, and other things after you leave college. Don’t be surprised if you find it difficult to live all by yourself after graduation. We’ve all been there, you have to make tough choices. Most importantly, you must take decisions related to money very wisely. Remember, you will be financially independent after graduation. Today, in this article, we’ll be sharing some useful money tips for college graduates. Go through the following tips carefully and you wouldn’t have to worry about your financial position.

5 Best Money Tips for College Graduate

Set a Monthly Budget: Setting up a monthly budget is the best way to limit your expenses and to avoid unnecessary outgoing of money. Sometimes, you may have to cross the assigned budget due to unavoidable circumstances. But, try your level best to limit the spendings. Take help of a financial app to track your expenses and income transactions. It won’t cost you anything, but you’ll surely have a track of your all spending.

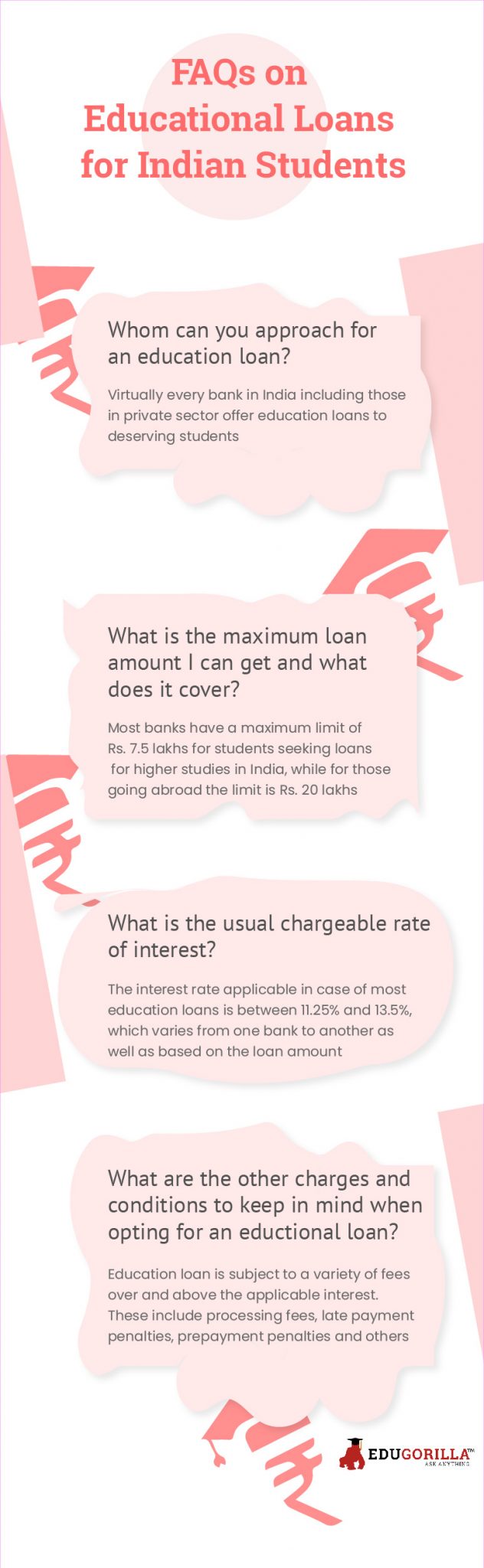

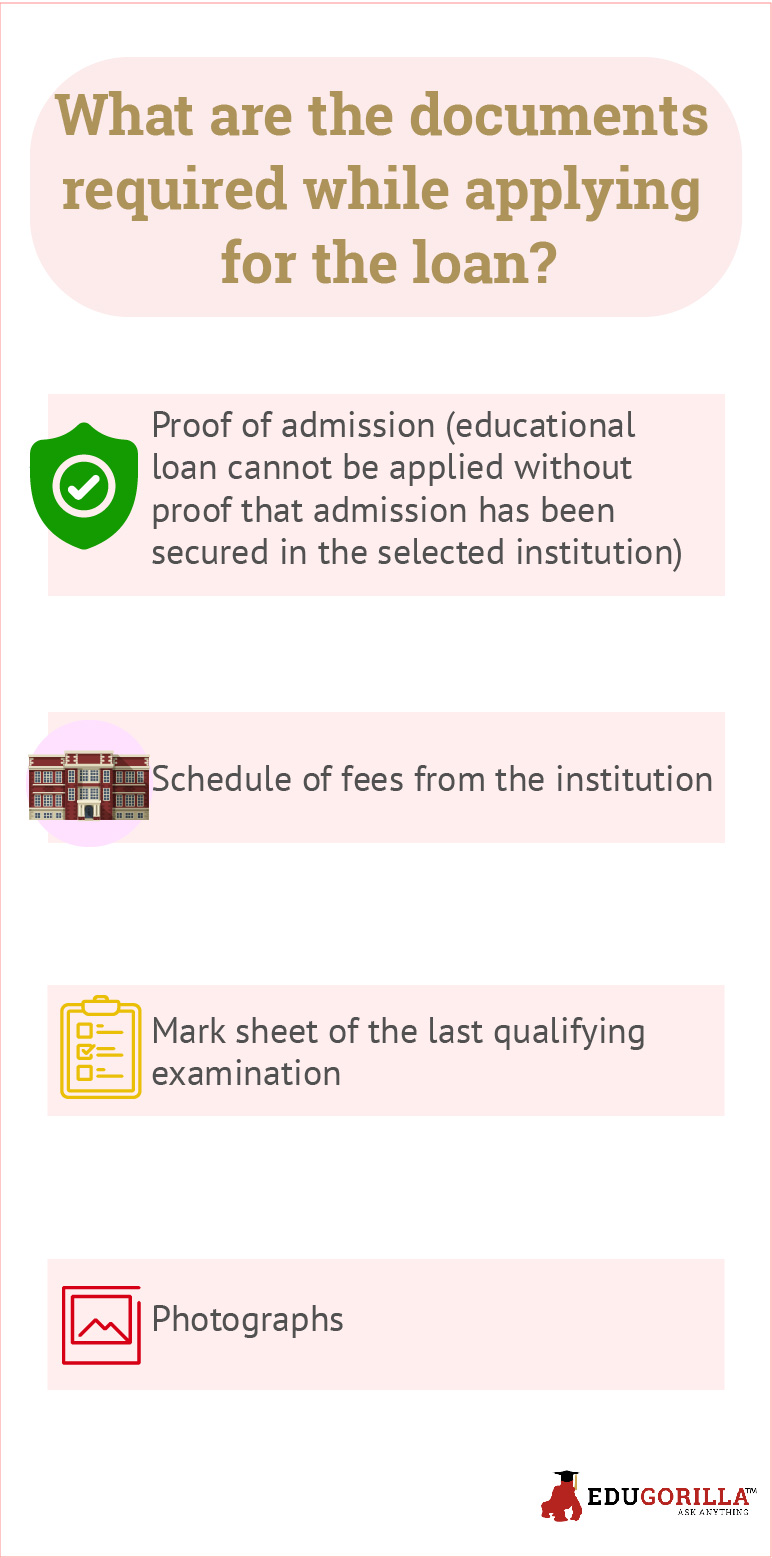

Clear Your Loans: As per the recent surveys, over 80% of the graduates have their student loans pending. Consider yourself lucky and be grateful if you’re not one of them. But if you do have a loan pending, start paying it off. The sooner you clear your loan, the better. Do not neglect or make delays in repayments, the interest rate will probably give you a lot of burden in the future. Get a job and start making the repayments to get rid of the loan as soon as possible.

Accept Any Job: If you’re in India, chances are, you’re not going to a high paying or your dream job as soon as you get off the college. You will have a hard time finding your desired job, meanwhile, don’t be shy or afraid to accept a low paying job. It’s better to have some monthly income than having no income at all.

Start Investing: Investing is the probably the best thing you could do during your working career. As soon as you get your salary, cut off all the expenses and keep the rest of the money in FD or make a SIP. The more money you invest during your working life, the more you gonna live tension-free in the future.

Be Disciplined: One day, you may find a really good looking dress or a smartphone deal online, and obviously, you may want to buy it. But before doing that, just think, do you really need that? If you can still do just fine without buying that deal or dress, then refrain yourself from spending your hard earned money. Sometimes, you will have to control your emotions or desires in order to save money.

That’s it for now, just follow the above-mentioned tips and you should be good with your financial life. You can learn more about money saving tips from trickyfinance. Don’t forget to share your tips or thoughts in the comment section.

You Might Want To Read:

Management Question Paper 2 2008, 3 Blank Text Completion Part 8 Video, Meridian Courses Mukherjee Nagar, Upsc Ies Iss Statistics Paper Iv Question Paper 2018, Chemical Bonding And Molecular Structure, Institute Actuaries India Examinationsfinance Financial Reporting Mock Test Paper 27, How To Study While You Are In The Military, Ssc Je Exam Syllabus 2017, Pharmacology Question Paper 8 2009, Doeacc C Level Network Security And Cryptography Mock Test Paper 70

Leave your vote

This post was created with our nice and easy submission form. Create your post!

Like what you read? Give author a thumbs up?

Bookmark this article to read later, drop a remark in comment section and share with your friends..